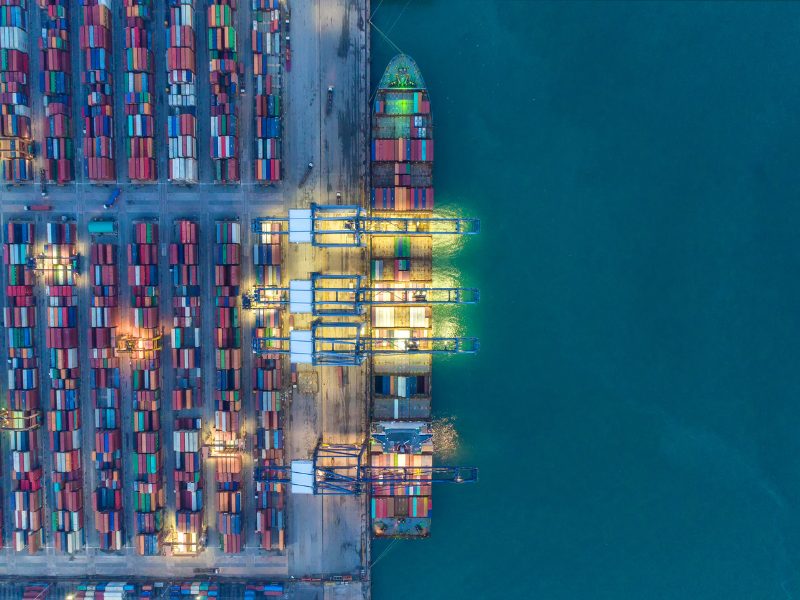

An overview of key practices and common pitfalls in the international shipments of technology equipment, such as servers, satellite antennas, and sensitive electronic components.

The global logistics of high-value IT products demand meticulous attention to tariff classification, documentation, packaging, regulatory compliance, and customs procedures at destination. Every aspect matters to prevent delays, added costs, or damage, and to secure trouble-free delivery.

Modern technology products—such as servers, telecommunications equipment, and satellite devices—are highly sensitive to impact, vibration, and unsuitable environmental conditions. Even minor physical damage or exposure to moisture or extreme temperatures can result in operational failures or reduced performance. Furthermore, the international trade of these products is subject to strict regulations, requiring accurate documentation, technical certifications, and compliance with local standards in each destination country.

Below are the DOs (recommended actions) and DON’Ts (practices to avoid) for successfully importing and exporting IT products, helping prevent common mistakes that may delay customs clearance.

Key Factors for Successful IT Product Import and Export

Correct Classification of Products (HS Codes)

Use the appropriate tariff classification (HS codes) for each technology item being exported or imported. Incorrect classification can lead to delays, customs penalties, or even seizure of goods by the authorities. Tariff headings determine applicable duties and restrictions, making accurate assignment essential.

Preparing Complete and Accurate Documentation

Have all required customs documents ready and completed without errors. These include the commercial invoice, packing list, bill of lading (B/L) or air waybill (AWB), certificates of origin (when applicable under trade agreements), and technical documentation for the product. Missing original signed documents or inaccurate information is one of the leading causes of customs delays. Attach copies of the invoice, permits, or special notes to the shipment, preferably in an envelope or pouch affixed to the package, so that customs officers can verify the contents without opening the box.

Compliance with Regulations and Certifications in the Destination Country

Verify and adhere to all mandatory technical standards, safety requirements, and certifications applicable in the destination market. Many electronic and telecommunications devices require specific approvals; for example, CE marking for the European Union, FCC certification for the United States, or equivalent local standards in Asia and Latin America. If products do not meet the required safety or quality standards—such as electrical directives or hazardous substance restrictions—entry into the country may be denied.

Securing Special Permits and Licenses in Advance

Determine whether the IT product to be exported or imported is subject to prior permits or restrictions in any of the countries involved. Certain telecommunications equipment, radio devices, encryption systems, or satellite technology may require import licenses issued by government agencies (such as approvals from a telecommunications regulatory authority or national security permits) or even export licenses in the country of origin.

Using Protective and Appropriate Packaging for Electronic Equipment

Packaging is the first line of defense to keep equipment intact during transit. Use multi-layer reinforced cartons or treated wooden crates custom-built for heavy equipment, along with high-density foam inserts, corner protectors, and vibration-absorbing cushions. Delicate components—such as circuit boards or memory modules—should be placed in anti-static (ESD) bags within the packaging to prevent damage from electrostatic discharge.

Common Mistakes That May Delay Customs Clearance

Underestimating Variability Among Local Customs Authorities

Assuming that all customs offices operate in the same way is a common mistake. Each country has its own procedures, regulatory interpretations, and level of scrutiny. A shipment that clears quickly in one destination may be held for days in another. Understanding these differences in advance is important to avoid unexpected costs.

Selecting Logistics Providers Without Technology Expertise

Not all freight forwarders manage IT products with the same proficiency. Lack of care in handling, unfamiliarity with technical requirements, or limited experience with specific customs processes can result in delays or damage. Always prioritize providers with proven specialization in technology.

Improvising During Customs Inspections

An unplanned inspection can cause difficulties if documentation or clear responses are not readily available. Attempting last-minute solutions with scattered emails or without official support can raise concerns. Prepare a complete, accessible technical dossier from the outset.

Overlooking Transit Time and Weather Conditions

Logistics routes are not always direct or fast. Certain IT products are sensitive to moisture, impact, or extreme temperatures. Failing to account for these factors in packaging or choosing flights with multiple layovers can lead to damage not covered by insurance.

Using Incoterms Without Understanding Their Actual Implications

Applying an Incoterm out of habit—such as FOB or EXW—without a clear understanding of who assumes the risks and costs can be counterproductive. For high-value technology products, clarity on responsibilities is vital to prevent disputes and delays.

Having a Reliable Importer of Record (IOR) at Destination

Rely on a trusted Importer of Record (IOR) when your company lacks a legal presence in the destination country or is unfamiliar with local regulations. This local representative will make sure that your goods comply with the laws and standards of the importing country, managing requirements such as tariff classification, payment of duties and taxes, acquisition of licenses and certifications, and any special customs procedures. In many complex markets, having a client or local entity is not enough; prior authorizations, licenses, and import permits may be required, varying by destination.

In addition to providing Importer of Record (IOR) services, Aerodoc offers a comprehensive logistics solution that includes DDP (Delivered Duty Paid) management, door-to-door deliveries, specialized document handling, global coverage, and regulatory advisory in challenging markets. This allows technology companies to delegate the entire import process to a single expert provider, with full traceability, compliance, and operational efficiency.

Contact our team of specialists to learn more about our IOR services.

Q&A

- What are the biggest hidden costs when importing and exporting IT products? Hidden costs often include demurrage charges, incorrect HS code duties, storage fees at customs, and re-certification of IT equipment. Careful planning and an Importer of Record service help reduce unexpected expenses.

- How can companies ensure compliance with cybersecurity regulations when exporting IT products? Many countries restrict imports of encrypted devices and telecom equipment. Companies should obtain prior export licenses and verify local cybersecurity certifications before shipping.

- What role do Incoterms play in importing and exporting IT products? Incoterms define who bears costs, risks, and responsibilities in the supply chain. For high-value IT equipment, terms like DDP or DAP provide greater control and minimize customs delays.

- Why is an Importer of Record (IOR) essential for IT product shipments? An IOR ensures regulatory compliance, secures necessary permits, and handles local tax obligations. Without a reliable IOR, IT shipments risk delays, fines, or rejection at customs.